jersey city property tax rates

461000 x 082 059 1060 annual increase in city tax expense. While Cape May County has the lowest property tax rate in NJ with an effective property tax rate of 128.

Axis Ecorp Launches Axis Lake City Lake City Lake City

The General Tax Rate is used to calculate the tax assessed on a property.

. The Jersey City sales tax rate is. Counties in New Jersey collect an average of 189 of a propertys assesed fair market value as property tax per year. The minimum combined 2022 sales tax rate for Jersey City New Jersey is.

In the citys defense last year it offset the 993 increase in school taxes by using 69 million in federal coronavirus relief funds to lower. Hudson County has one of the highest median property taxes in the United States and is ranked 14th of the 3143 counties in order of median property taxes. In fact rates in some areas are more than double the national average.

Ad Get In-Depth Property Reports Info You May Not Find On Other Sites. Select the Icons below to view the assessments in Adobe Acrobat or Microsoft Excel. Owners must also be given a prompt notice of levy escalations.

May 31 2022. In Jersey City the average residential school tax in 2021 was. Based on this rate and average market conditions you can expect to pay 6426 in annual property taxes.

Thus the annual estimated increase in city tax expense for a 461000 home can be computed as. Homeowners in New Jersey pay the highest property taxes of any state in the country. Table of Equalized Valuations.

As of the Fiscal Year End 2021 September 30 the City of Jersey Village has a total outstanding and tax-supported debt obligation of 8540000. Visit Our Official Website Today. New Jersey has one of the highest average property tax rates in the country with only states levying higher property taxes.

The average effective property tax rate in New Jersey is 242 compared to. Enter Any Address and Find The Information You Need. 1 Since 2018 the state of NJ has reduced 155 million of education aid to Jersey City.

1 be equal and uniform 2 be based on current market worth 3 have a single estimated value and 4 be considered taxable in the absence of being specially exempted. In the face of a 27 million state aid cut the BOE raised the levy only 12 millionAs a result 100 districtwide layoffs ensued. New Jersey Tax Court on January 31 2022 for use in Tax Year 2022.

Certified October 1 2021 for use in Tax Year 2022 As amended by the. City of Jersey City PO. The median property tax in Hudson County New Jersey is 6426 per year for a home worth the median value of 383900.

The New Jersey sales tax rate is currently. The median property tax in New Jersey is 657900 per year for a home worth the median value of 34830000. 6757 hqhudo 7d 5dwhiihfwlyh 7d 5dwh 1 252 31 252 51 252 227 252 5677 252.

The approved resolution states that the tax bills must be prepared and mailed by August 1. Pay By Mail - You can mail in your property tax payment amount in the form of a Check or money order to. Account Number Block Lot Qualifier Property Location 18 14502 00011 20 HUDSON ST.

Camden County has the highest property tax rate in NJ with an effective property tax rate of 391. Tax amount varies by county. Adding insult to injury the state issued an order in April compelling Jersey City to revaluate their properties by 2017 which theyve said they will comply with.

This equates to a total outstanding debt service per capita of 1078. Across the state the average homeowner pays 4908 a year in school taxes roughly half of the average property tax bill of 9284. The County sales tax rate is.

Online Inquiry Payment. Pay In Person - Walk-in payments can be made at The Tax Collectors office which is open 830 am. Photo by Mark Koosau.

Hudson County collects on average 167 of a propertys assessed fair market value as property tax. The Jersey City Council has unanimously passed a resolution to. 11 rows City of Jersey City.

Click here for a map with more tax information. General Tax Rate Average Tax Bill Average Residential Assessment. Per state data here the average home in Jersey City was assessed at 461000 in 2021.

Canceling the reval also led to a breach of contract lawsuit that the city recently lost which some fear could cost taxpayers upwards of 8 million. This was state-driven pressure to increase the school tax in Jersey City. The most recent debt transparency document can be found above under the column heading Financial Transparency Annual Reports.

This is the total of state county and city sales tax rates. Taxation of real property must. You can pay your Jersey City Property Taxes using one of the following methods.

Within those confines the city sets tax rates. County Equalization Tables. Jersey Citys average tax rate is 167 of assessed home valuesslightly lower than the New Jersey state average of 189.

NEW -- NJ Property Tax Calculator. Overview of New Jersey Taxes. It is equal to 10 per 1000 of the propertys taxable value.

2021 Table of Equalized Valuations for all of New Jersey. 2 In 2019 Jersey Citys board of education was slow to react to the state pressure. The proposed 2022 city tax rate is thus 324M39B 082.

Did South Dakota v. The Average Effective Property Tax Rate in NJ is 274.

Americans Are Migrating To Low Tax States Native American Map American History Timeline United States Map

Illinois Now Has The Second Highest Property Taxes In The Nation Chicago Magazine

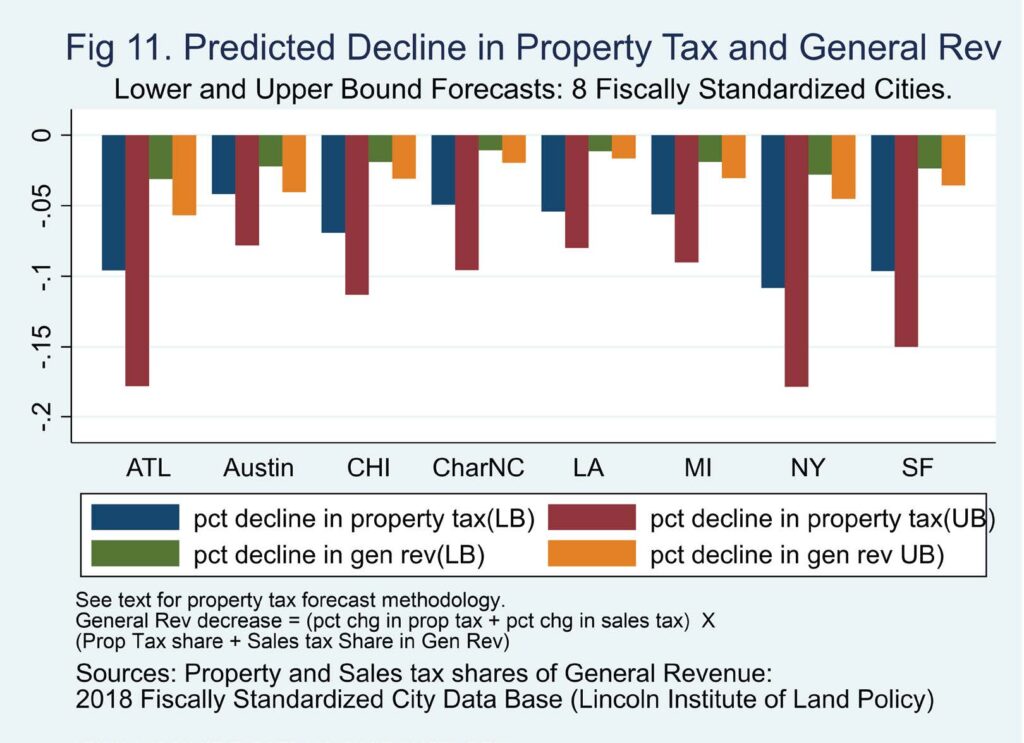

The Impact Of Work From Home On Commercial Property Values And The Property Tax In U S Cities Itep

Nevada Tax Rates Rankings Nevada State Taxes Tax Foundation

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

New York Property Tax Calculator Smartasset

2022 Property Taxes By State Report Propertyshark

States With The Highest And Lowest Property Taxes Property Tax Tax High Low

State Local Property Tax Collections Per Capita Tax Foundation

New York Property Tax Calculator 2020 Empire Center For Public Policy

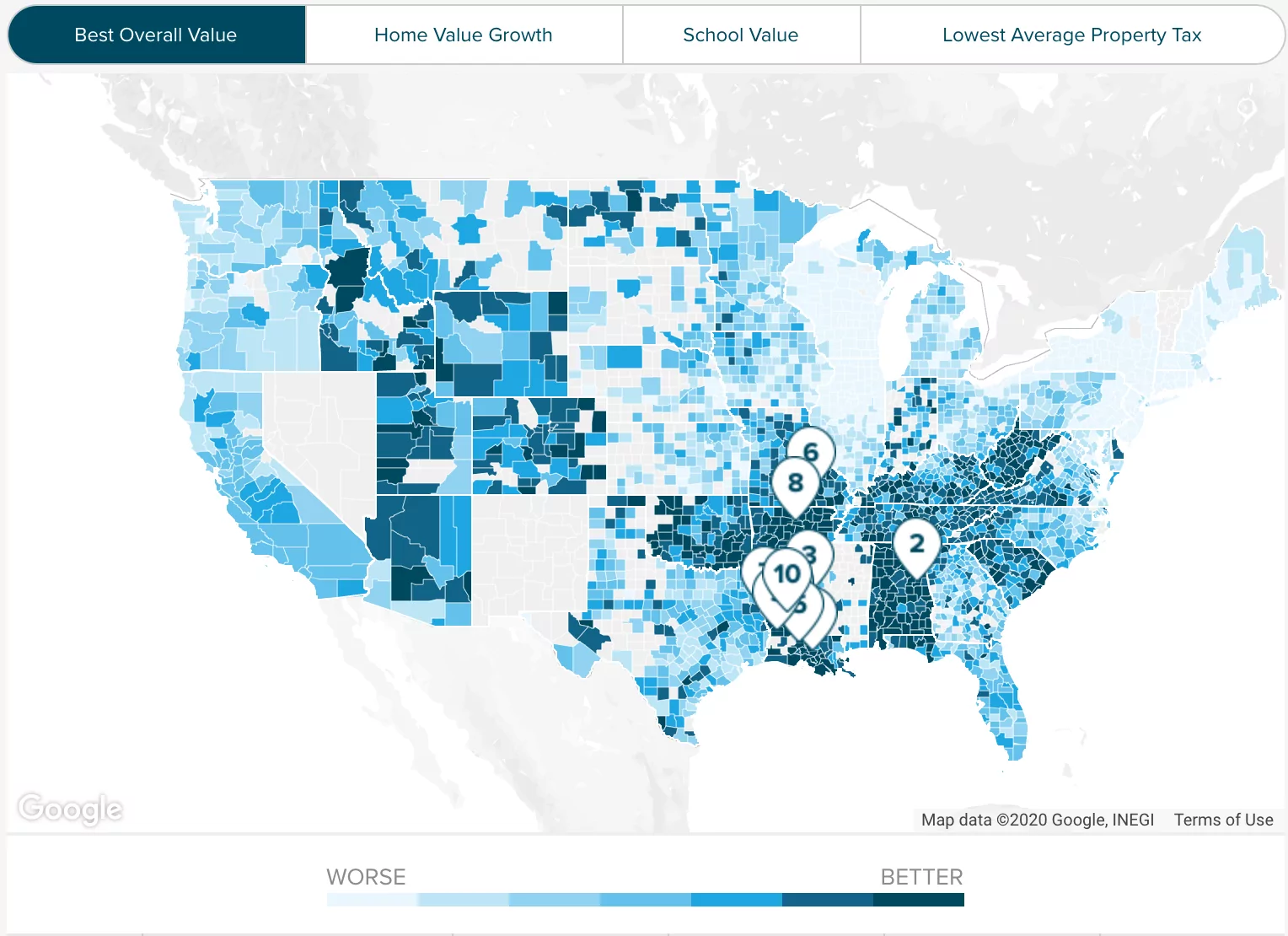

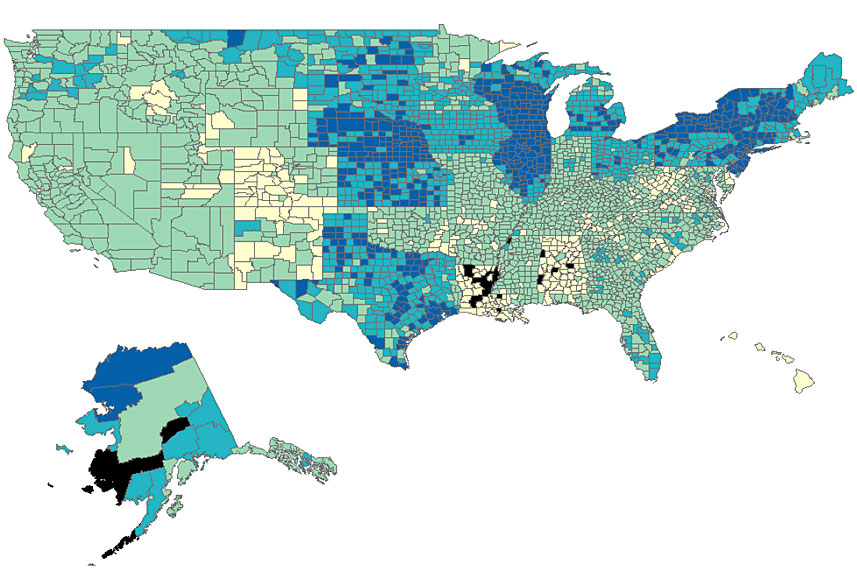

Property Taxes By State County Lowest Property Taxes In The Us Mapped

New Jersey 2021 Property Tax Rates And Average Tax Bills For All Counties And Towns

How Far Will Dollar Stretch Real Value Of 100 In Each State Revealed Map Usa Map United States Map

Why Identical Homes Can Have Different Property Tax Bills Lincoln Institute Of Land Policy

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

Monday Map State Local Property Tax Collections Per Capita Property Tax Teaching Government Map

Map The Most And Least Tax Friendly States Yahoo Finance Best Places To Retire Map Life Map

Pursuing A Property Tax Appeal In New Jersey Sharlin Law Warehouse Design Metal Building Homes Factory Architecture